Tax Brackets Uk 2019/20 . 2019/2020 tax rates and allowances. This increased to 40% for your earnings above £50,000 and. How much tax you’ve paid in the current tax year; income tax on earned income is charged at three rates: check your income tax to see: The basic rate, the higher rate and the additional rate. for tax year 2019/2020 the uk basic income tax rate was 20%. the psa taxes interest at nil, where it would otherwise be taxable at 20% or 40%. Dividends are normally taxed as the ‘top slice’ of. Click to select a tax section. Your personal allowance and tax code;

from brokeasshome.com

The basic rate, the higher rate and the additional rate. Click to select a tax section. 2019/2020 tax rates and allowances. the psa taxes interest at nil, where it would otherwise be taxable at 20% or 40%. income tax on earned income is charged at three rates: This increased to 40% for your earnings above £50,000 and. How much tax you’ve paid in the current tax year; check your income tax to see: Dividends are normally taxed as the ‘top slice’ of. Your personal allowance and tax code;

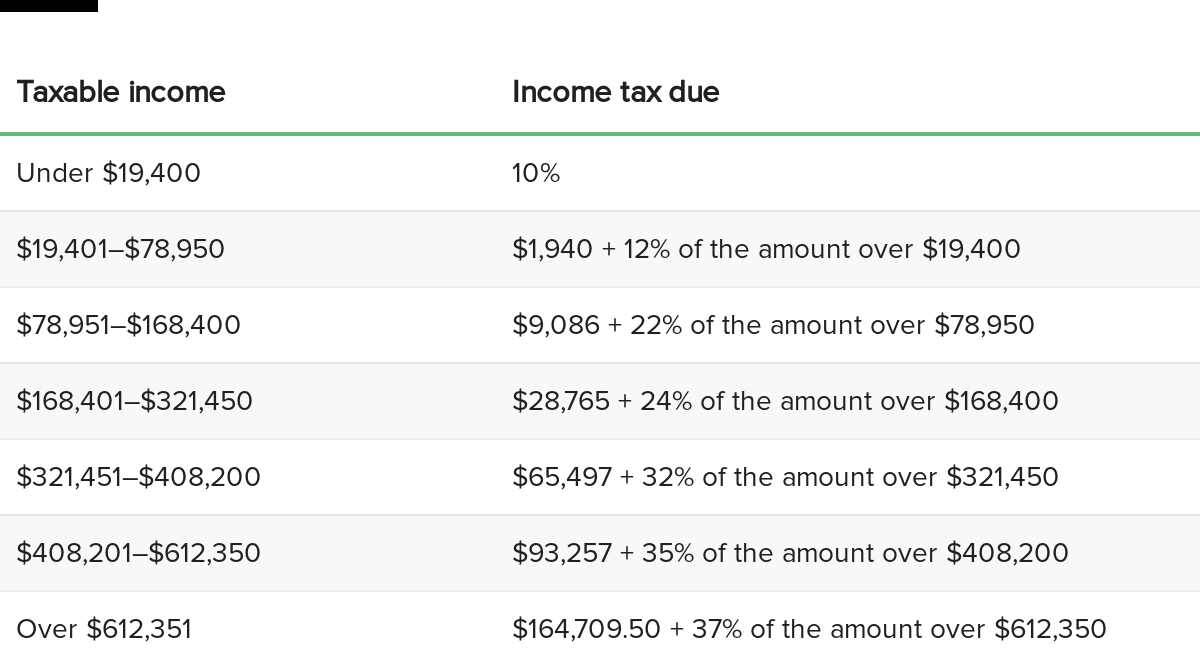

Irs Withholding Tax Tables 2019

Tax Brackets Uk 2019/20 2019/2020 tax rates and allowances. check your income tax to see: Dividends are normally taxed as the ‘top slice’ of. the psa taxes interest at nil, where it would otherwise be taxable at 20% or 40%. The basic rate, the higher rate and the additional rate. Click to select a tax section. income tax on earned income is charged at three rates: This increased to 40% for your earnings above £50,000 and. Your personal allowance and tax code; for tax year 2019/2020 the uk basic income tax rate was 20%. How much tax you’ve paid in the current tax year; 2019/2020 tax rates and allowances.

From brokeasshome.com

Irs Withholding Tax Tables 2019 Tax Brackets Uk 2019/20 income tax on earned income is charged at three rates: Dividends are normally taxed as the ‘top slice’ of. Your personal allowance and tax code; 2019/2020 tax rates and allowances. check your income tax to see: The basic rate, the higher rate and the additional rate. This increased to 40% for your earnings above £50,000 and. . Tax Brackets Uk 2019/20.

From formdop.weebly.com

2019 tax brackets formdop Tax Brackets Uk 2019/20 income tax on earned income is charged at three rates: Your personal allowance and tax code; 2019/2020 tax rates and allowances. for tax year 2019/2020 the uk basic income tax rate was 20%. check your income tax to see: Dividends are normally taxed as the ‘top slice’ of. Click to select a tax section. How much. Tax Brackets Uk 2019/20.

From conomo.helpapp.co

2019 federal tax chart Conomo.helpapp.co Tax Brackets Uk 2019/20 How much tax you’ve paid in the current tax year; 2019/2020 tax rates and allowances. income tax on earned income is charged at three rates: The basic rate, the higher rate and the additional rate. Dividends are normally taxed as the ‘top slice’ of. Click to select a tax section. This increased to 40% for your earnings above. Tax Brackets Uk 2019/20.

From www.purposefulfinance.org

IRS 2019 Tax Tables, Deductions, & Exemptions — purposeful.finance Tax Brackets Uk 2019/20 check your income tax to see: The basic rate, the higher rate and the additional rate. How much tax you’ve paid in the current tax year; Your personal allowance and tax code; income tax on earned income is charged at three rates: the psa taxes interest at nil, where it would otherwise be taxable at 20% or. Tax Brackets Uk 2019/20.

From pdfprof.com

2019 tax brackets married filing single Tax Brackets Uk 2019/20 Click to select a tax section. Dividends are normally taxed as the ‘top slice’ of. 2019/2020 tax rates and allowances. This increased to 40% for your earnings above £50,000 and. The basic rate, the higher rate and the additional rate. check your income tax to see: Your personal allowance and tax code; the psa taxes interest at. Tax Brackets Uk 2019/20.

From www.financial-planning.com

How Roth IRA conversions can escalate capital gains taxes Financial Planning Tax Brackets Uk 2019/20 This increased to 40% for your earnings above £50,000 and. 2019/2020 tax rates and allowances. the psa taxes interest at nil, where it would otherwise be taxable at 20% or 40%. Click to select a tax section. The basic rate, the higher rate and the additional rate. Dividends are normally taxed as the ‘top slice’ of. income. Tax Brackets Uk 2019/20.

From www.bbc.com

tax How will thresholds change and what will I pay? BBC News Tax Brackets Uk 2019/20 Dividends are normally taxed as the ‘top slice’ of. check your income tax to see: the psa taxes interest at nil, where it would otherwise be taxable at 20% or 40%. for tax year 2019/2020 the uk basic income tax rate was 20%. The basic rate, the higher rate and the additional rate. Your personal allowance and. Tax Brackets Uk 2019/20.

From www.tolley.co.uk

Tax Rate 2019 Tolley Tax Brackets Uk 2019/20 The basic rate, the higher rate and the additional rate. Click to select a tax section. income tax on earned income is charged at three rates: for tax year 2019/2020 the uk basic income tax rate was 20%. Dividends are normally taxed as the ‘top slice’ of. How much tax you’ve paid in the current tax year; . Tax Brackets Uk 2019/20.

From www.bbc.co.uk

tax How will thresholds change and what will I pay? BBC News Tax Brackets Uk 2019/20 How much tax you’ve paid in the current tax year; the psa taxes interest at nil, where it would otherwise be taxable at 20% or 40%. This increased to 40% for your earnings above £50,000 and. for tax year 2019/2020 the uk basic income tax rate was 20%. The basic rate, the higher rate and the additional rate.. Tax Brackets Uk 2019/20.

From winningsilope.weebly.com

Tax brackets 2019 winningsilope Tax Brackets Uk 2019/20 Dividends are normally taxed as the ‘top slice’ of. The basic rate, the higher rate and the additional rate. 2019/2020 tax rates and allowances. income tax on earned income is charged at three rates: Your personal allowance and tax code; Click to select a tax section. the psa taxes interest at nil, where it would otherwise be. Tax Brackets Uk 2019/20.

From celimpzo.blob.core.windows.net

Tax Brackets Uk Business at Diana Max blog Tax Brackets Uk 2019/20 Your personal allowance and tax code; How much tax you’ve paid in the current tax year; income tax on earned income is charged at three rates: Dividends are normally taxed as the ‘top slice’ of. The basic rate, the higher rate and the additional rate. check your income tax to see: This increased to 40% for your earnings. Tax Brackets Uk 2019/20.

From korpsteer.blogspot.com

Lhdn 2019 Tax Rate / 2019 standard deductions have gone up but a couple hundred bucks. korpsteer Tax Brackets Uk 2019/20 Your personal allowance and tax code; Dividends are normally taxed as the ‘top slice’ of. The basic rate, the higher rate and the additional rate. check your income tax to see: for tax year 2019/2020 the uk basic income tax rate was 20%. the psa taxes interest at nil, where it would otherwise be taxable at 20%. Tax Brackets Uk 2019/20.

From winningsilope.weebly.com

Tax brackets 2019 winningsilope Tax Brackets Uk 2019/20 income tax on earned income is charged at three rates: Click to select a tax section. check your income tax to see: the psa taxes interest at nil, where it would otherwise be taxable at 20% or 40%. This increased to 40% for your earnings above £50,000 and. for tax year 2019/2020 the uk basic income. Tax Brackets Uk 2019/20.

From www.tillerhq.com

2019 Tax Brackets Spreadsheet Tax Brackets Uk 2019/20 Your personal allowance and tax code; Click to select a tax section. the psa taxes interest at nil, where it would otherwise be taxable at 20% or 40%. The basic rate, the higher rate and the additional rate. check your income tax to see: income tax on earned income is charged at three rates: 2019/2020 tax. Tax Brackets Uk 2019/20.

From haysmacintyre.com

Scottish Tax Rates update haysmacintyre Tax Brackets Uk 2019/20 This increased to 40% for your earnings above £50,000 and. check your income tax to see: income tax on earned income is charged at three rates: The basic rate, the higher rate and the additional rate. How much tax you’ve paid in the current tax year; Dividends are normally taxed as the ‘top slice’ of. the psa. Tax Brackets Uk 2019/20.

From www.ntu.org

Tax Brackets for 2021 and 2022 Publications National Taxpayers Union Tax Brackets Uk 2019/20 How much tax you’ve paid in the current tax year; check your income tax to see: the psa taxes interest at nil, where it would otherwise be taxable at 20% or 40%. Dividends are normally taxed as the ‘top slice’ of. This increased to 40% for your earnings above £50,000 and. income tax on earned income is. Tax Brackets Uk 2019/20.

From swirled.com

2019 Tax Guide What You Need To Know This Year Tax Brackets Uk 2019/20 income tax on earned income is charged at three rates: 2019/2020 tax rates and allowances. check your income tax to see: The basic rate, the higher rate and the additional rate. This increased to 40% for your earnings above £50,000 and. Your personal allowance and tax code; Dividends are normally taxed as the ‘top slice’ of. . Tax Brackets Uk 2019/20.

From www.rockethq.com

20192020 Federal Tax Brackets And Rates RocketHQ Tax Brackets Uk 2019/20 check your income tax to see: the psa taxes interest at nil, where it would otherwise be taxable at 20% or 40%. for tax year 2019/2020 the uk basic income tax rate was 20%. income tax on earned income is charged at three rates: Your personal allowance and tax code; 2019/2020 tax rates and allowances.. Tax Brackets Uk 2019/20.